U Microfinance Bank Ltd.

U Microfinance Bank Ltd., a PTCL-Etisalat subsidiary, operates 350+ branches across Pakistan, offering microfinance, deposit products, and U Paisa branchless banking at 50,000+ agent locations with Ufone collaboration.

Table of Contents

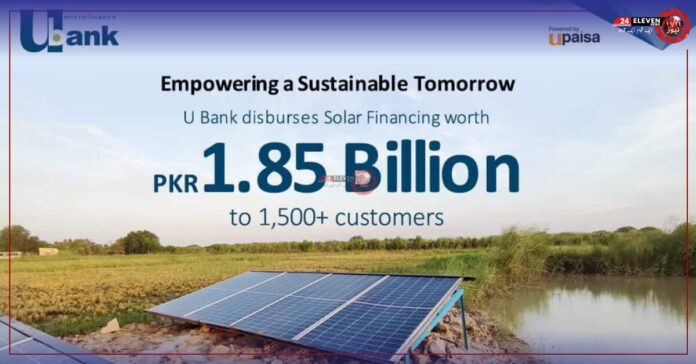

U Bank Facilitates a Sustainable Tomorrow with PKR 1.85 Billion Disbursed in Solar Financing

Recent media coverage has predominantly highlighted Pakistan’s record-breaking inflation and the consequential surge in electricity prices. In the face of economic uncertainty, Pakistan’s residents have grappled with an ongoing energy crisis, heavily relying on expensive fossil fuels for power generation. This burden has affected households and industries across urban and rural areas, leaving minimal room for savings and improvement in living standards.

Furthermore, the looming threat of climate change exacerbates the situation. Escalating temperatures and erratic weather patterns spike energy demands, further elevating prices. Simultaneously, the depletion of non-renewable energy sources compounds environmental concerns.

Read More: Current Account Transitions from Deficit to Surplus After 4 Months

In response to these challenges, the adoption of solar energy emerges as a promising solution. U Microfinance Bank has proactively introduced its Solar Financing facility, disbursing loans totaling PKR 1.85 billion across Pakistan. This initiative aligns with market needs, emphasizing sustainable business solutions.

Empowering Through Cost-Effective Solutions

U Bank’s Solar Financing facility has benefited over 1,500 customers across diverse socio-economic segments nationwide. The program aims to enable customers to install solar panels, promoting cost-effective solutions that enable savings. The bank’s initiative caters to:

1. Brightening Up Homes with Affordable Solar Financing

Offering competitive interest rates and flexible repayment options, U Bank assists homeowners in installing economically viable solar panels. This reduces traditional electricity usage, resulting in reduced bills and carbon footprint, empowering households financially for future investments.

2. Energizing Agriculture and Enabling Farmers’ Success

Recognizing agriculture’s significance in Pakistan’s economy, U Bank extends its Solar Financing to farmers. This allows them to power their tube wells and homes sustainably, reducing operational costs and contributing to a cleaner environment. The initiative aims to bolster the financial stability of farming communities.

Read More: Petroleum Products’ Production Records 8% Surge in Initial Four Months of FY24

3. Powering Businesses through Sustainable Energy

For businesses and enterprises, U Bank’s Solar Financing provides cost-effective energy solutions, aiding business sustainability while contributing to environmental preservation.

Despite Pakistan’s abundant sunlight, only a fraction of its electricity (1.16%) is sourced from solar power, while a significant portion (64%) comes from fossil fuels. A shift towards solar energy not only mitigates rising electricity bills and inflationary pressures but also fosters environmental stability, reducing greenhouse emissions and combating climate change.

In the face of inflation and environmental challenges, U Bank’s Solar loans offer a ray of hope for Pakistanis. By promoting solar energy adoption, U Bank empowers individuals, farmers, and businesses towards a more sustainable and resilient economy.