The Salt Manufacturers Association of Pakistan is really worried about a change the Federal Board of Revenue (FBR) wants to make. They want to switch from using a fast and automated system called “FASTER” to a slower manual process for giving back sales tax refunds. This change is seen as a big problem for the salt industry.

The association wrote a letter to the head of FBR to express their concerns. They mentioned that many businesses in their industry have had trouble using the current automated system called “FASTER” to get their sales tax refunds. The “FASTER” system was introduced a few years ago to make it easier for companies, especially those that export goods, to get their tax refunds quickly.

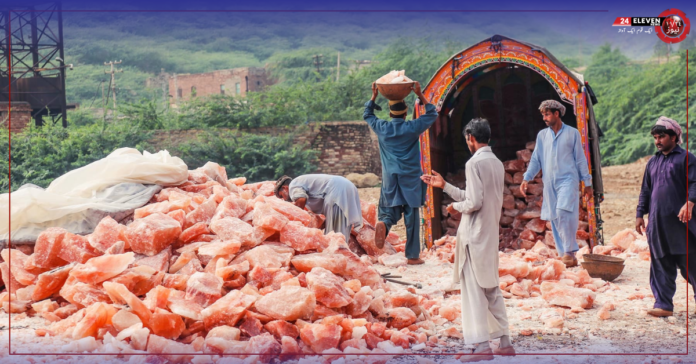

The salt industry appreciates the government’s efforts to make things easier with systems like “FASTER.” But there’s a problem. This system is only available to a few specific industries, leaving out many others, including the salt industry. This is unfair because the salt industry has the potential to help Pakistan’s economy, and it has been doing well with foreign salt buyers.

However, recently, the “FASTER” system has started rejecting tax refund claims from businesses in sectors that are not part of the specific industries it was meant for. This is causing trouble for the salt industry because it means they have to go through a manual process to get their refunds. This manual process takes more time, and it also goes against the rules, which say refunds should be given within 45 days.

Read More: Reko Diq: Foreign Investment Sparks Hope for Balochistan’s Economic Transformation

Because of this change, businesses in sectors outside the specified ones are facing cash flow problems. It means they have to wait for about four to six months to get their refunds, which is a long time.

This switch from a fast and automated system to a slower manual one doesn’t make sense in a world where technology is used to speed things up. It’s disappointing to see Pakistan going in the opposite direction. It goes against the global trend, and it’s a setback for an economy that’s already struggling with high inflation.

Despite the FBR‘s promise to reduce the need for human involvement in these processes, their recent actions seem to be doing the opposite. It’s unclear why they are making this change, and it’s only creating more problems and obstacles for businesses that really need their tax refunds.

For More Updates Stay Tuned to our website 24Elevennews.tv